No products in the cart.

UOB's net profit for the whole year reached a record 6 billion yuan, an increase of about 6% year-on-year. After deducting the one-time cost of integrating Citigroup, the core net profit was 6.233 billion yuan, an increase of about 3% year-on-year.

Dahua released its fourth-quarter and full-year results for the year ended December 31, 2024 before the market opening Wednesday (February 19).

The board of directors recommends paying 92 cents of the year-end dividend per share, plus an interim dividend of 88 cents per share, and paying 1.8 yuan per share for the whole year. The dividend payment rate is about 50%, and the dividend payment date is May 13. In addition, the board of directors also proposed to pay a special dividend of 50 cents per share, which will be paid in two installments.

The group's annual net interest income was RMB 9.674 billion, the same year-on-year; mainly due to the impact of 5% loan growth and interest rate changes on the net interest rate return (NIM).

Driven by the improvement of investor sentiment, Dahua's net fee income increased by 7% year-on-year to 2.4 billion yuan last year; other non-interest income reached 2.2 billion yuan, a year-on-year increase of 10%.

Further reading

Dahua Insurance's net profit fell 10% to 15.6 million yuan in the second half of the year

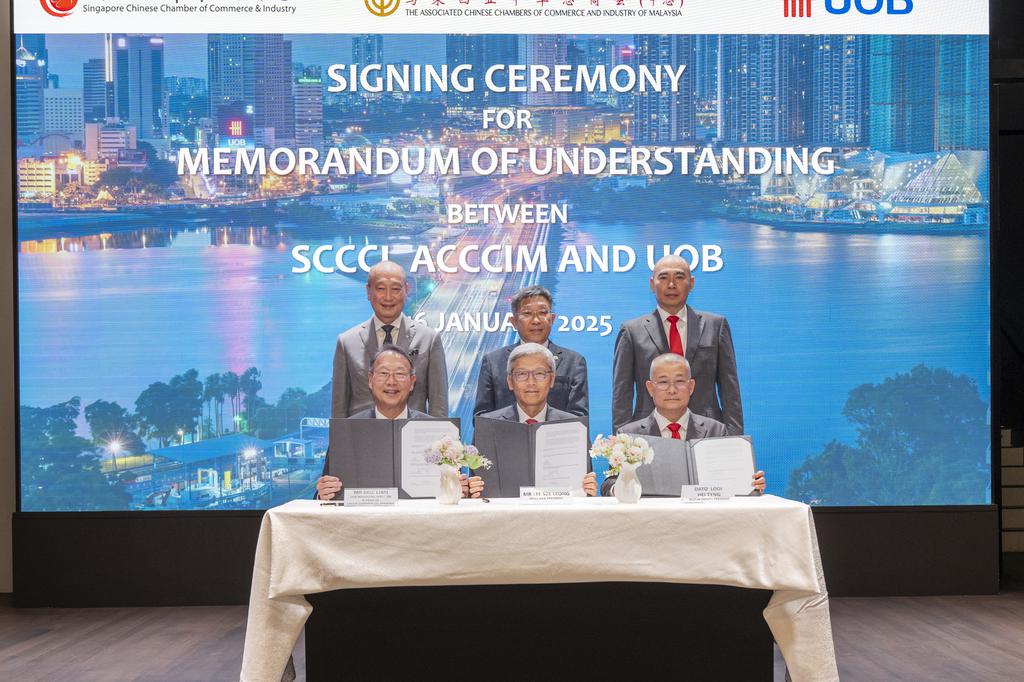

Singapore-Malaysia China Chamber of Commerce and UOB Cooperation to Promote Cross-border Commercial Cooperation and Investment

In the third quarter of 2024, net profit fell by 5% to 1.5 billion yuan in the fourth quarter of last year; net interest income was 2.5 billion yuan; affected by the decline in interest rates, the net interest rate (NIM) narrowed to 2%, but 1% The increase in loans partially offsets this impact. Net fee income fell back to 567 million yuan month-on-month, and other non-interest income fell back to 443 million Singapore dollars.

As part of the bank's capital allocation strategy, Dahua announced a 3 billion yuan plan that is expected to allocate surplus capital in the next three years. The plan includes special dividends and stock buybacks, which in addition to a special dividend of 50 cents per share, also includes a 2 billion yuan stock buyback program.

As of December 31, 2024, UOB's non-performing loan ratio was stable at 1.5%.

Charity In China ,charityinchina.cn