No products in the cart.

There are already various low-cost funds for members to invest under the Provident Fund Investment Program. In addition to these funds they can choose, if a more comprehensive and structured low-cost life cycle fund is to be established, it must be able to provide higher interest rates than special accounts and continue to do so.

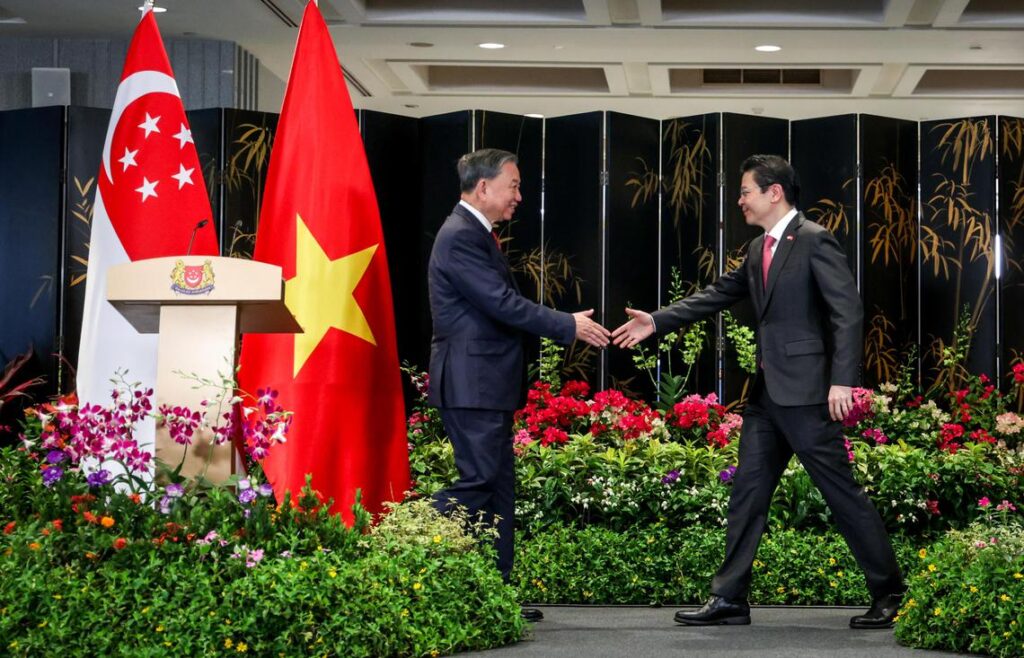

Prime Minister Wong Xuncai stressed in his congressional summary of the government's fiscal policy debate for the new fiscal year on Friday (February 28), that people can choose to take more risks to get higher potential returns, but the government must consider how to provide security for Singaporeans.

Lifecycle funds refer to fund varieties that can automatically adjust the asset allocation ratio according to the risk-return characteristics of investors at each stage of life.

“If you are lucky, you may get a return of 7% or more, but what if you are unlucky? What if you retire when the market is down, what should you do?”

He also said that how to provide protection for Singaporeans is an issue that the government must consider carefully. The government will definitely continue to review, adjust and improve the provident fund system to better meet the needs of the elderly and prepare for a future where longevity and life expectancy become longer.

Further reading

Premier Huang: Provident fund is the unique retirement security system

Premier Huang: Provident fund will not be adjusted statically and must be carried out with caution

Premier Huang recently said in an exclusive interview with Lianhe Zaobao that the government is still studying whether to set up a retirement investment fund to provide members with an additional investment option that can guarantee returns, but there is no conclusion yet. The main reason is that the establishment of a new fund may not be able to do better than the existing system, and may put members in the face of certain financial market risks.

Charity In China ,charityinchina.cn