No products in the cart.

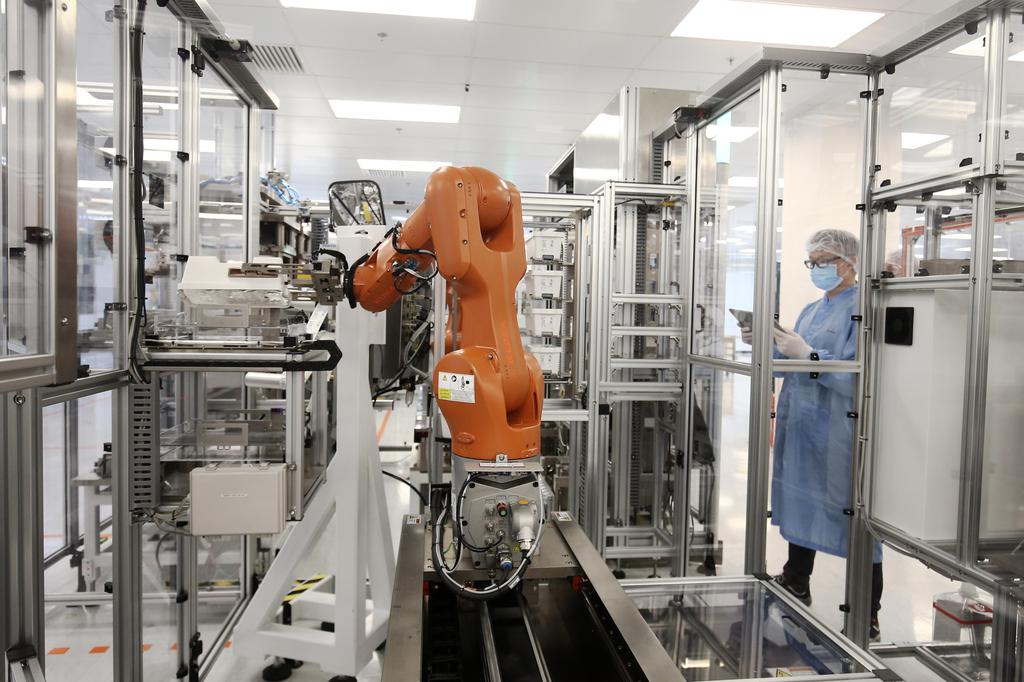

ASEAN manufacturing industry showed significant improvement in February, output growth accelerated, new order volume increased significantly, and the corporate confidence index also rose to a 22-month high.

S&P Global released ASEAN Manufacturing Purchasing Managers Index (PMI) data on Monday (March 3), showing that the manufacturing PMI rose to 51.5 in February, higher than 50.4 in January, and hit a seven-month high. Since January 2024, this index has improved for several consecutive months.

Strong new orders and outputs and accelerated growth support the improvement of manufacturing performance. Among them, the growth rate of new orders was the strongest in six months, while the growth rate of output hit a seven-month high.

ASEAN manufacturers also had confidence in output, with the index rising to a 22-month high.

The rise in production demand and the increase in expected workload have prompted enterprises to expand their operating capabilities. Procurement activities and employment levels are growing at a faster rate. The increase in procurement activities has driven a slight increase in inventory, which is the first time that procurement inventory has increased in eight months.

Further reading

ASEAN manufacturing industry achieved a slight growth at the end of 2024

In November, ASEAN Manufacturing PMI grew for the first time in half a year and continued to improve its operating conditions

Finished product inventory has dropped slightly again, indicating that companies are using inventory to partially meet sales demand.

However, the growth trend of backlog orders is still continuing, but the growth rate of backlog orders in February slowed compared with January, indicating that measures to support production have eased production capacity pressure to a certain extent. Cost pressure is basically the same as in January, and the inflation rate of output prices remains unchanged from January.

Maryam Baluch, global market finance and intelligence economist at S&P, said strong demand trends in February drove steady growth in new orders, and corporate output levels also increased simultaneously. “Despite recent rise in regional manufacturing activity, inflation pressures have remained suppressed and overall are still at historically low levels.”

Charity In China ,charityinchina.cn