No products in the cart.

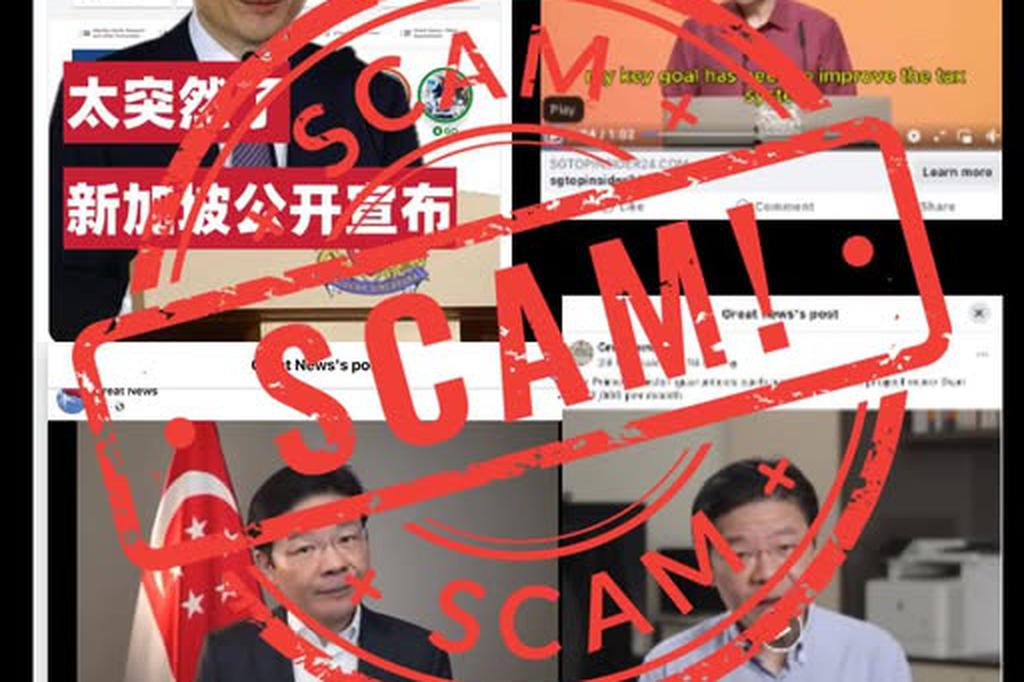

It claimed that the premium will be automatically deducted from the bank account soon, and the fraud gang impersonated the National Workers' Federation, Yingkang Insurance, the Monetary Authority of Singapore and other institutions to embezzle the victim's bank information. The police have received at least six reports since January this year, with the amount involved exceeding 1.7 million yuan.

The Singapore Police Force and the HKMA issued a statement on Friday (March 14) saying that in such fraud cases, the victim will generally receive a local phone number starting with “+65” or “8”. The other party claims to be from the General Secretary of the Communist Party of China, Yingkang Insurance or UnionPay, saying that the victim has a brand new or imminent life insurance policy under his name and must pay the premium.

The scammer will then forward the phone number to the accomplices and ask the victim to provide personal information such as bank account on the grounds of verifying the policy information. The scammer then informed the victim that if the “insurance policy” is not cancelled, the unpaid fees will be automatically deducted from the bank account. The victim is advised to send money to the designated bank account to cancel the “insurance policy” by verifying the account.

Some cases scammers even guide victims how to send money through WhatsApp screen sharing feature. During the process, the scammers will repeatedly assure the victim that once the policy is cancelled, a full refund will be made.

Other victims spoke with scammers who pretended to be the HKMA. The scammer will refer to the victim's bank account involved in money laundering activities or personal information is leaked, and money must be remitted to the designated bank account to assist in the investigation.

Further reading

Prime Minister Huang urges the public not to be deceived

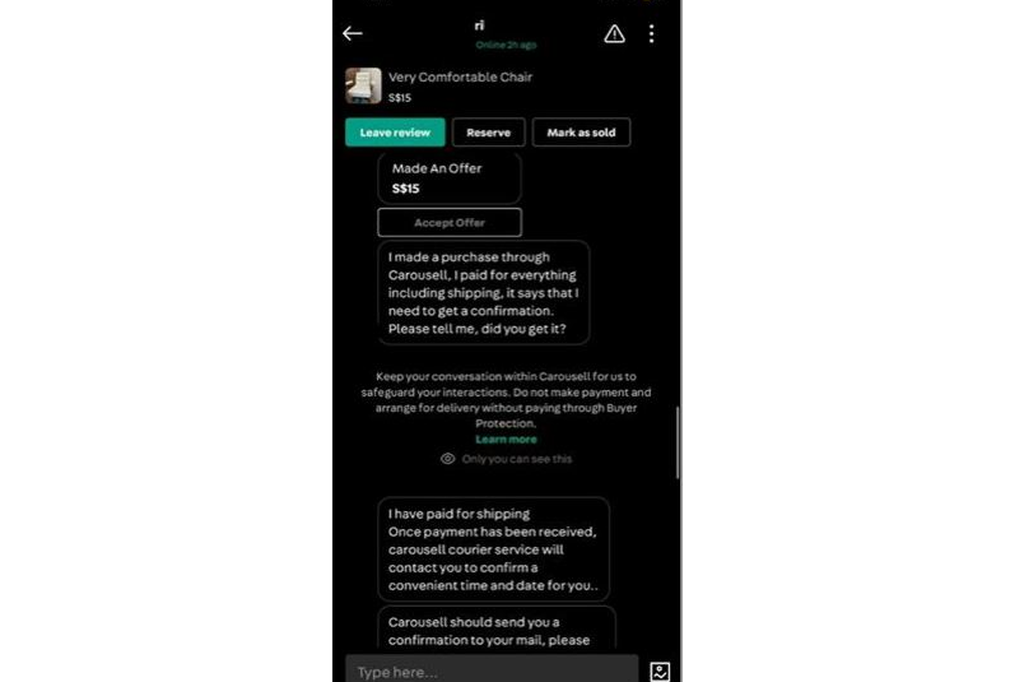

Scammers pretend to be employees of e-commerce platforms, and 12 people have lost more than 1.4 million yuan since January

Victims generally realize that they are deceived only when the scammer loses contact or does not receive the so-called refund.

The statement pointed out that the General Secretary of China, Yingkang Insurance and UnionPay will not require the public to provide personal information or remittance via phone, email, WhatsApp or text message. All premiums can only be paid through Yingkang Insurance's secure payment channels, such as the official client platform, ME@INCOME, interactive voice recognition (IVR) call system, AXS service machine and online banking bills.

If there is any doubt, the public can go to Yingkang Insurance Branch or call 6788-1777 to report suspicious activities. Policy holders can also contact the insurance consultant for assistance.

The HKMA also said that the authorities will not ask the public to remit money or provide personal and bank information, nor will they leave any person's financial or bank account records, or collect anyone's money.

Charity In China ,charityinchina.cn